In July 1988, ‘International Convergence of Capital Measurement and Captal Measurement and Captal Students’ Generally know as the Basel Capital Accord was created by the Basel Committee on Banking Supervision (BCBS), Basel, in Switzerland. The Basel I Accord, was designed to establish minimum Levels of capital for internationally active banks. The committee’s (BCBS) work on regulatory convergence had two fundamental objective; Primarily, the framework should serve to strengthen the soundness and stability of the international banking system. Secondly, the framework should be fair and have high degree of consistency in its application to banks in different countries with a view to diminishing on existing source of competitive inequality among international banks. Initially, the capital accord recognized only credit risk. Subsequently, the market risk was also brought under the capital accord. Thus, Basel I focused on credit and market risk.

Following the East Asian Financial Crisi, the Credit Risk Management system was updated and new requirements to cover operational risk were created. A New Framework know as the Basel II norms which refers to a document called ‘International Convergence of Capital Measurement and Capital Standards: A Revised Framework’ was released by the Basel Committee on Banking Supervision (BCBS) on June 26, 2004.

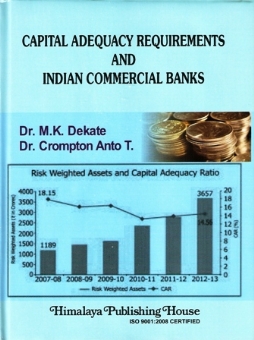

The Basel Committee’s norms were initially addressed to international banks based in G-10 countries but over time the prudential regulators handed over to all kinds of banks irrespective of the domestic or international nature of their activities. The minimum Capital to Risk-weighted Assets Ratio (CRAR) has been specified at 8 per cent by the Basel Committee on Banking Supervision (BCBS) under both the Basel I and Basel II framework.

Basel III is the new international regulatory requirement resigned to correct the deficiencies in the system. It seeks higher capital adequacy ratio to meet any financial exigency. As per the new norms, banks were required to share up their capital at 7 per cent of risk-weighted assets. Although banks in India have higher capital requirement under Basel II, their tier I or equity capital needs to be stored up to meet the norms. The Basel Committee has prescribed a retail roadmap for smooth transition to Basel III standards between January 1, 2003 and January 1, 2019.

The financial tsunami originated in United States in 2008 devastated economies of several countries. The epicenter was the reckless sub-prime lending of US investment banks. The root cause of 1991 South East Asia Crisis was also germinated in the faulty financial system. These incidents remind that weak and fragile policies in banking system can create disastrous and chaotic structure in national and international economies.

A sound and efficient banking system is sine qua non for maintaining financial stability. Therefore considerable emphasis has been placed on strengthening the capital requirement in recent years.

Contents :

1. Introduction

2. Commercial Banks – Structure, Roles and Function

3. Requirements of Capital Adequacy and Implementation

4. Capital Funds for Capital Adequacy Requirement

5. Role and risk Weights on Assets

6. Operational and managerial Constraints

7. Impact and Implication of Capital Adequacy Requirements

Appendix Tables